Röd öppning Red Opening 1 November 2023

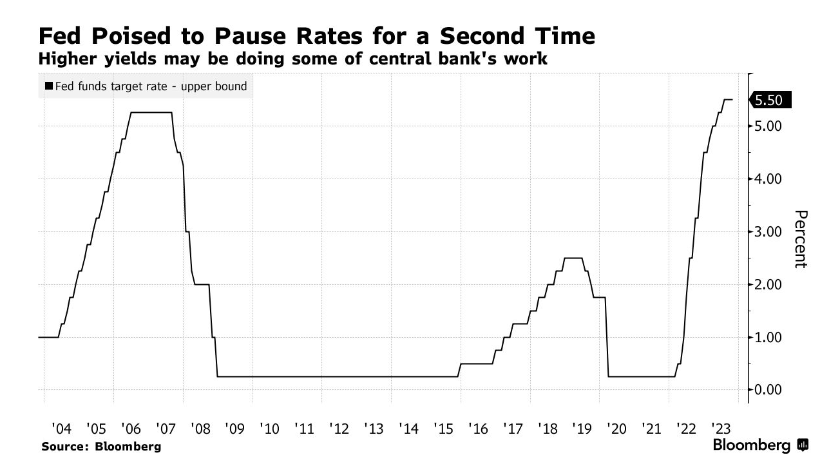

Fed Holds Rates Steady but Keeps Door Open to Another Hike

November 01, 2023

Federal Reserve issues FOMC statement

Erik Thedéen tror i alla fall att inflationstoppen är passerad i Sverige.

”Jag tycker att det finns gott hopp om det. Den stora frågan är om den kommer ned på ett uthålligt sätt till 2 procent. Men vi ser inte någon stor risk att vi ska komma tillbaka till 10 procent, det ligger inte i korten”,

https://www.di.se/nyheter/thedeen-vi-maste-halla-huvudet-kallt-nu/

Byggbolaget Skanska tog en nedskrivning, aktien rasade 12,4 procent och hade sin fjärde sämsta börsdag någonsin.

DI 1 November 2023

https://www.di.se/live/svag-nedgang-infor-fed-besked-historiskt-kursras-i-skanska/

Officials can offer various arguments for keeping interest rates on hold, which is what markets fully expect them to do

I see four potentially fatal flaws in this thinking.

First, the labor market — albeit in better balance — is still too tight for the Fed to reach its 2% inflation objective.

Second, the economy’s performance strongly suggests that monetary policy isn’t sufficiently restrictive.

Third, monetary policy doesn’t operate with the same lags that it used to. Financial conditions move faster,

Fourth, the notion that higher long-term interest rates can substitute for additional monetary tightening depends critically upon why long-term rates have increased.

The higher bond yields could reflect an increase in the “neutral” federal funds rate above which monetary policy becomes restrictive,

or they could indicate increased inflation expectations.

In either case, higher short-term rates would be needed to exert the same degree of restraint.

Fed officials are trying to achieve two goals: push inflation down to 2% and avoid a recession.

This creates the risk of a mistake.

Bill Dudley Bloomberg 1 november 2023

Trade the News, Then Publish It

One thing that I think about sometimes is the similarity between journalism and insider trading. What do you do with this information? Here are three possibilities

Option 3 It seems clear to me that if you have one subscriber and a million-dollar subscription, that’s insider trading

Probably at five subscribers it is still insider trading.

On the other hand, at a million subscribers and a $200 subscription, you are clearly a journalist: Publishing a story behind a paywall, to paying customers who get it before everyone else, still counts as journalism.

Matt Levine Bloomberg 1 Novenber 2023

The importance of the grid, and just how much work needs to be done.

Unless the U.S. and other developed countries reinvent their electricity grids, the revolution in clean energy that has given us radically cheaper solar and wind power will be for naught.

Solar panels and wind turbines are coming online at a record pace, and clean energy is getting cheaper and more reliable than ever before.

But clean power sources are often situated far from cities where the most people live. That means new transmission lines are needed. Building them is arduous and expensive, and often faces local opposition.

David Gelles NYT Oct. 31, 2023

Englund: Why We Need to Build a More Robust Power Grid (englundmacro.blogspot.com)

The number of ships allowed to cross the Panama Canal each day will be slashed in the coming months as climate change increasingly rocks global trade.

FT 1 Bovember 2023

https://www.ft.com/content/b6604ad4-d2c9-4a00-8a50-1241fa86f26c

South Africa is famous for its tortured road to democracy, its world-beating rugby team, its wine and its cultural diversity — but in business and finance circles, the country’s inability to generate enough electricity is seen as its magnum opus.

That would be a mistake, though, because the country has a more serious and knotty problem: the collapse of its logistics network

Snowballing problems at Transnet, the state-owned passenger and freight rail, ports and fuel-pipeline operator, will be more harmful to South Africa and the region in the long-run than the energy crisis.

Bloomberg 31 oktober 2023

The 2023 Interconnected Disaster Risks report

analyses six interconnected risk tipping points, representing immediate and increasing risks across the world.

November 2023

Englund: Climate Tipping Points May Be Triggered (englundmacro.blogspot.com)

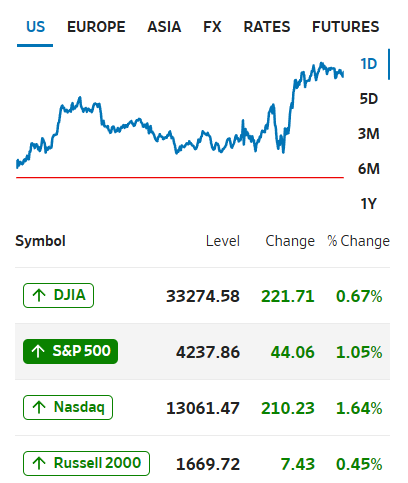

World markets peaked at Halloween 2007. They fell the following day,

largely on a warning that Citigroup Inc. might have to cut its dividend. We didn’t even know the half of it. A financial meltdown that would sweep the planet and a savage bear market lay ahead.

But although we now know that crisis as a “global”one, at this point it appears to have excluded the US, at least judging by stock markets.

US earnings per share have more than doubled over the last 16 years. For the rest of the world, they’re barely changed.

Virtually all the narratives that might explain this are discomfiting. They fall into the left-wing school — that holds that US companies have been allowed to merge, jack up margins and exploit workers, thus making profits while the population is miserable

— and the libertarian or Austrian school, which would hold that endemic interference with markets has led to malinvestment, moral hazard, and a bubble that must soon blow up.

Now that it’s happened, the US collapse after the dot-com bubble burst seems to have been inevitable. Whatever happens to the US stock market in the years ahead, it’s hard to avoid the feeling that we should be able to see it coming. And surely a regime of treats for Americans and tricks for everyone else can’t endure much longer.

John Authers Bloomberg 1 November 2023

In his new book, The Guarded Age: Fortification in the Twenty-First Century,

David Betz, a professor at King’s College, London, points out that walls are only part of a mass of fortifications arising across the planet.

Some fortifications are deliberately visible: Look at the razor wire that surrounds many public buildings (or private houses in countries such as South Africa).

Many are concealed. Major cities are littered with concrete benches and reinforced bollards designed for “hostile vehicle mitigation.”

Bloomberg 31 October 2023

Kommentarer