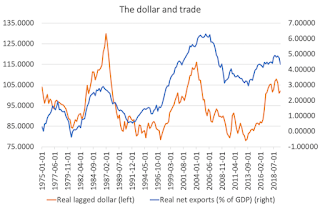

Mainly because the effects of a strong dollar on trade, while they can be powerful, take a long time to materialize. In international macroeconomics, one of my home academic fields, the general view — shaped in large part by the effects of a rising dollar in the early 1980s, then a big fall after 1985 — has been that the negative impact of a strong dollar on the trade balance takes two years or more to fully manifest. Following that theory, here’s a plot of a measure of the average value of the dollar against other major currencies, adjusted for inflation, versus the real trade deficit as a percentage of G.D.P., in which I’ve lagged the exchange rate by eight quarters: We have yet to see anything like the full effects of Fed tightening on the economy. So does the Fed need to do more, or has it already done too much? It’s a judgment call. Over the past year, optimists like me were wrong, while pessimists were right. But past results are no guarantee of future performance. Paul Krugman