We have lived in a world of near-zero interest rates for 14 years now

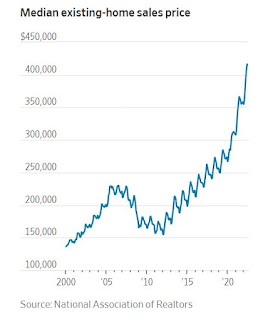

Ultra cheap money created a bitter generational divide as soaring house prices made it impossible for younger people to get on the property ladder; it created legions of zombie companies that were kept barely alive on easy credit; it encouraged feckless spending by governments that thought the bills would never fall due; it created an explosion of debt and fuelled asset-price bubbles; and it destroyed the incentive to save. True, free money might have helped rescue the economy in the wake of the financial crisis of 2008 and 2009. But one day interest rates will have to get back to normal – and now is the moment. Matthew Lynn Telegraph 30 July 2022 https://www.telegraph.co.uk/business/2022/07/30/how-rock-bottom-interest-rates-harm-good/ Bill Gross 2021: “One of these days, one of these years, or one of these decades, the system will collapse, because capitalism depends on savers saving and investing.” https://englundmacro.blogspot.com/2021/11/2005-alan-greenspan-complained-of.html