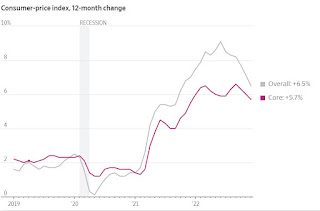

Still a long way to 2 percent

Why Investors May Be Too Optimistic About Inflation

In December 1974, celebrated historian and sometime presidential speechwriter Arthur M. Schlesinger Jr. summed up the problem with contemporary forecasters in a single, very long sentence in The Wall Street Journal:

“To this moment most economists, businessmen and government officials obstinately regard inflation not as the structural vulnerability of contemporary capitalism but rather as the accidental result of unlucky coincidences requiring only patience, time (and unemployment) for its alleviation.”

The new geopolitics is splitting the world into two blocs, partially reversing the globalization of the past three decades.

On the domestic front, efforts to reduce global warming will continue to increase spending in the push to reduce fossil fuels. The International Energy Agency estimates that to reach emissions targets, very large amounts—$4 trillion a year by 2030, about triple what is currently spent—will need to be invested in alternatives to fossil fuels.

Domestic politics in the U.S. and Europe appear to have switched from free-market capitalism to more government intervention and industrial policy.

On the domestic front, there is also newfound willingness of governments to borrow and spend. The austerity that followed the global financial crisis of 2008-09 was rightly abandoned

Finally, demographics is working to push up inflation. After decades of adding tens of millions of well-educated, low-cost workers to the global economy every year, China has seen its working-age population begin to shrink.

None of this matters if the Fed is willing to do what it takes to control inflation, points out Olivier Blanchard, a former chief economist of the International Monetary Fund now at the Peterson Institute for International Economics.

“Central banks are totally committed to getting inflation under control,” he says. “The issue is whether they go back to 2% or do they aim for something slightly higher.”

I’m less convinced that central banks will be willing to lift interest rates enough to get inflation back to superlow levels if the trends outlined above continue.

Bond markets are priced on the premise that inflation will rapidly fall back to the Fed’s 2% target and stay there, without the Fed needing to do anything really dramatic.

Markets are not prepared for the higher rates required if inflationary pressures prove persistent, as I expect.

Worse, central bankers might not be prepared to take flak from a society that has become reliant on easy money, and may quietly accept price rises higher than their targets.

James Mackintosh Senior columnist WSJ 11 January 2023

https://www.wsj.com/articles/investors-optimistic-inflation-11673452446

Nog är 5,7 procent fortfarande högt men med mer än ett kvartal i bagaget börjar det verkligen likna en trend att luta sig mot.

Så långt, allting gott. Vad kan pessimisterna, inte minst de ledamöter i Federal Reserve som vill hålla den hårda linjen, då peka på? Framför allt tjänsteinflationen, som fortfarande ligger på 7 procent.

Här är trenden inte lika tydlig – tvärtom steg tjänstepriserna något igen jämfört med november månad.

Det är i prognoserna för den andra halvan av året som splittringen syns.

Terminshandeln visar att investerarna fortfarande hoppas på räntesänkningar innan året är över, på tesen att centralbanken kommer behöva göra helt om när konjunkturen viker och inflationen fortsätter att mattas av.

Felicia Åkerman DI 12 januari 2023

https://www.di.se/nyheter/splittringen-mellan-wall-street-och-fed-kvarstar/

Kommentarer