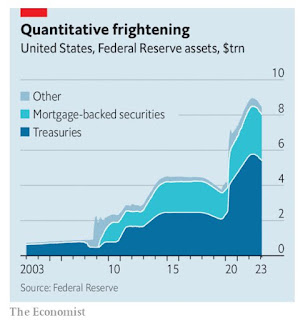

Can a central bank make $2.5trn of cash vanish without anyone much noticing?

QT is as QE in reverse.

Just as QE involves creating central-bank reserves to buy bonds, so QT involves removing reserves as the central bank pares back its holdings.

Initially qt drains money from a commercial-banking system that is awash in liquidity; as it continues, however, liquidity gets steadily tighter, and funding costs for banks may soar without much warning.

Some banks, having recently lost deposits, have turned to the federal-funds market to borrow reserves from other lenders in order to meet regulatory requirements. Daily borrowing in the fed-funds market in January averaged $106bn, the most in data going back to 2016.

The Economist 9 Fabruary 2023

https://www.economist.com/finance-and-economics/2023/02/09/the-federal-reserves-25trn-question

Kommentarer