There’s angst about recessions and stagflation in the air

The job of braking the economy seems to be under way already. But we still need to explain exactly why growth ran negative.

The decline was driven by the trade balance

That leads to the issue of currency: A strong currency is good for inflation, because it makes imports cheaper, but is bad for growth, as it makes exports less competitive in both the home and foreign markets.

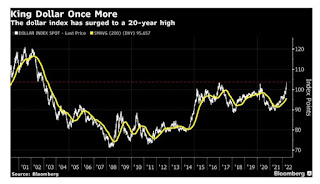

We find that the greenback’s surge has brought it to its strongest valuation in 20 years

The prospect of higher rates is attracting fund flows to the U.S.

Emerging countries are far less dependent on dollar debt now than they were in the 1990s, but this will still hurt.

The carry trade — borrowing in a currency with low interest rates and parking in a higher-rate currency — is appealing. So far, it’s working.

The problem with carry trades, as was learned in 2008, is that when they turn, they can turn with a vengeance.

John Authers Bloomberg 29 april 2022

U.S. Goods-Trade Gap Soars to Record, Surpassing All Estimates

https://englundmacro.blogspot.com/2022/04/us-goods-trade-gap-soars-to-record.html

Carry Trade Biggest Returns Since 2016

https://englundmacro.blogspot.com/2021/10/carry-trade-biggest-returns-since-2016.html

Kommentarer