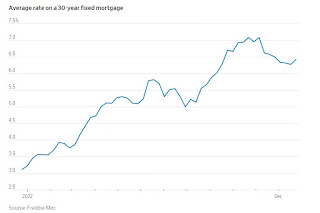

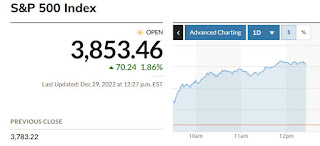

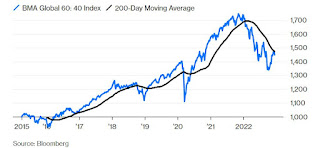

Kolanovic, JPMorgan Chase's co-head of global research, predicted a broad rally. He and his team pinned the S&P 500 Index at 5,050 by the end of 2022. Stoltzfus, the chief investment strategist at Oppenheimer, was even bolder: 5,330. They were off by more than 1,000 points. With few exceptions, the best and brightest in stock and bond markets failed to appreciate how the inflation outbreak would upend the investing world in 2022. They failed to anticipate how the Fed would react — the rate increases came at a torrid, not measured, pace — and failed to foresee how that, in turn, would trigger the worst simultaneous rout in stocks and bonds since at least the 1970s. There are 865 actively managed stock mutual funds domiciled in the US with at least $1 billion in assets. On average, they lost 19% in 2022. Bloomberg 29 December 2022 https://www.bloomberg.com/news/articles/2022-12-29/why-wall-street-got-inflation-interest-rate-predictions-wrong-in-2022 Much better off g...