The defense of the euro gave us negative interest rates

Fed chairman Alan Greenspan stood at the top of his reputation in the early 2000s. Legendary journalist Bob Woodward - who, along with Carl Bernstein, unveiled Watergate and forced President Nixon to resign - published his book Maestro: Greenspan's Fed And The American Boom.

In 2002, he was awarded the honorary Knight of the British Empire by Queen Elizabeth II for his "contribution to global economic stability".

Then came the financial crisis and the Lehman Brothers went bankrupt in 2008. The disaster was imminent and there is now as much consensus as it can among economists, that Greenspan was one of the culprits by holding interest rates too low for too long.

Then came the euro crisis.

Greece was the most urgent problen, but it was resolved for the time being by the EU lending money to Greece so that Greece could pay its loans to the banks.

- The big risk was that Greece would trigger a crisis in Italian, French and German banks. In practice, there is now an EU guarantee for the outstanding Greek government bonds, then Swedish Finance minister Anders Borg said on February 22, 2012.

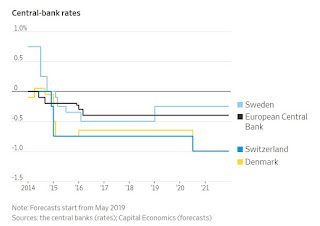

But the euro crisis persisted. A turning point came when ECB chief Draghi in 2014 held a famous press conference proclaiming that he would save the euro, "whatever it takes", lowered the interest rate to zero and then below zero.

In March 2015, the ECB initiated Quantitative easing (QE) and in October 2018 ECB had bought € 2.5tn (1tn = 1000bn) of euro area securities.

In addition, complex things, like Targeted long-term refinancing operation - TLTRO, Outright Monetary Transactions ("OMT") and Target2 European interbank payment system, were introduced.

Draghi saved the euro, at least for the time being, and now before his departure has the same star gloss as once Allan Greenspan.

But the ECB's minus interest rates spread around the world, firing on real estate, bond and stock prices to an alarmingly high level.

Unfortunately, nobody seems to know how to get out of this.

If Draghi had not saved the euro by "whatever it takes" measures, we would not have had today's situation.

It would have been better if the euro had not existed today. It was not a good idea to introduce it before all the pieces were in place, whenever that will be it, if ever.

Rolf Englund

https://internetional.se/index.html

In 2002, he was awarded the honorary Knight of the British Empire by Queen Elizabeth II for his "contribution to global economic stability".

Then came the financial crisis and the Lehman Brothers went bankrupt in 2008. The disaster was imminent and there is now as much consensus as it can among economists, that Greenspan was one of the culprits by holding interest rates too low for too long.

Then came the euro crisis.

Greece was the most urgent problen, but it was resolved for the time being by the EU lending money to Greece so that Greece could pay its loans to the banks.

- The big risk was that Greece would trigger a crisis in Italian, French and German banks. In practice, there is now an EU guarantee for the outstanding Greek government bonds, then Swedish Finance minister Anders Borg said on February 22, 2012.

But the euro crisis persisted. A turning point came when ECB chief Draghi in 2014 held a famous press conference proclaiming that he would save the euro, "whatever it takes", lowered the interest rate to zero and then below zero.

In March 2015, the ECB initiated Quantitative easing (QE) and in October 2018 ECB had bought € 2.5tn (1tn = 1000bn) of euro area securities.

In addition, complex things, like Targeted long-term refinancing operation - TLTRO, Outright Monetary Transactions ("OMT") and Target2 European interbank payment system, were introduced.

Draghi saved the euro, at least for the time being, and now before his departure has the same star gloss as once Allan Greenspan.

But the ECB's minus interest rates spread around the world, firing on real estate, bond and stock prices to an alarmingly high level.

Unfortunately, nobody seems to know how to get out of this.

If Draghi had not saved the euro by "whatever it takes" measures, we would not have had today's situation.

It would have been better if the euro had not existed today. It was not a good idea to introduce it before all the pieces were in place, whenever that will be it, if ever.

Rolf Englund

https://internetional.se/index.html

Kommentarer