Gavyn Davies, The very long run equity bull market and Lawrence Summers and Paul Krugman on secular stagnation

The very long run equity bull market

Gavyn Davies, FT blog, Nov 09 2014

-It is obvious that the inability of workers to maintain their previous trend growth in real wages would tend to increase the share of profits in GDP, and therefore be beneficial for equities, but why has this also led to a decline in real interest rates?

The reason given in the Goodhart/Erfurth paper will be familiar to readers of recent work by Lawrence Summers and Paul Krugman on secular stagnation.

Essentially, the argument is that lower real wages have increased inequality in the western economies, and this has depressed aggregate demand by redistributing real income and wealth away from the relatively poor towards the rich.

Since the poor have a higher propensity to consume than the rich, this redistribution reduces consumer demand.

Full text

Secular Stagnation

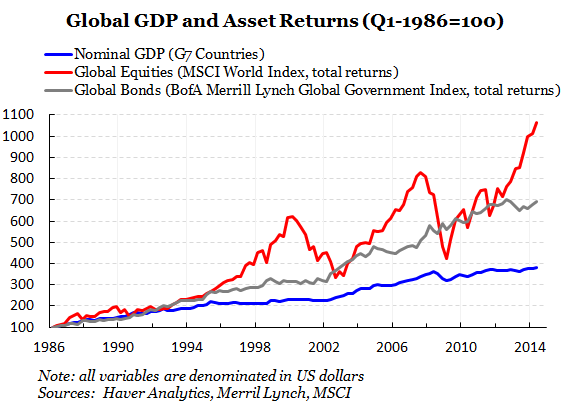

The Stock Market

The Bond Market

Gavyn Davies, FT blog, Nov 09 2014

-It is obvious that the inability of workers to maintain their previous trend growth in real wages would tend to increase the share of profits in GDP, and therefore be beneficial for equities, but why has this also led to a decline in real interest rates?

The reason given in the Goodhart/Erfurth paper will be familiar to readers of recent work by Lawrence Summers and Paul Krugman on secular stagnation.

Essentially, the argument is that lower real wages have increased inequality in the western economies, and this has depressed aggregate demand by redistributing real income and wealth away from the relatively poor towards the rich.

Since the poor have a higher propensity to consume than the rich, this redistribution reduces consumer demand.

Full text

Secular Stagnation

The Stock Market

The Bond Market

Kommentarer